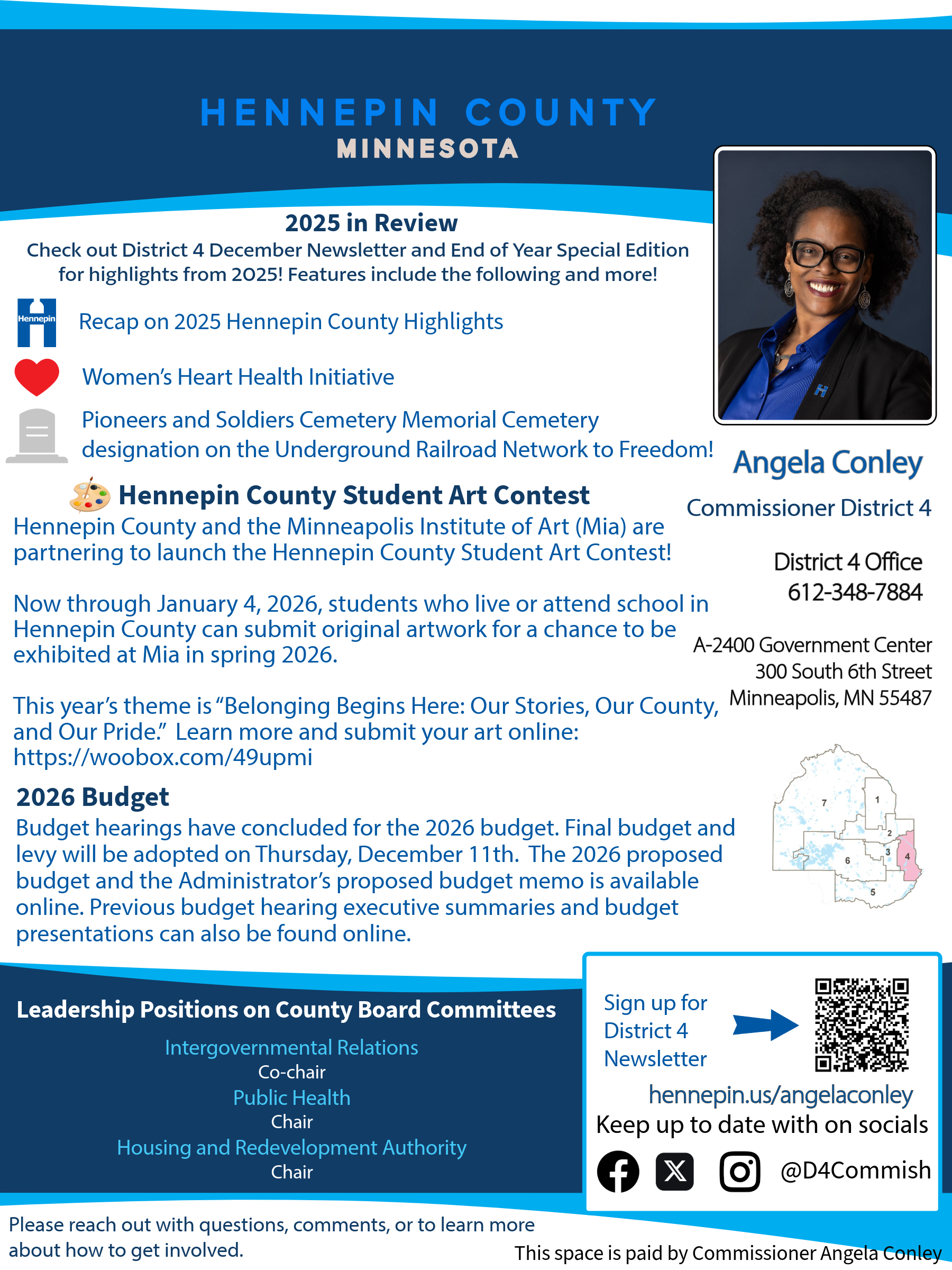

By NICOLE ROTHSTEIN , a contributing writer for Sunrise Banks.

Over the next few weeks, as winter gives way to clearer skies and greener grass, many people will turn their thoughts toward buying or selling a home.

April through June is typically peak homebuying season – homes tend to sell faster, competition is higher for buyers and more homes are on the market.

Will 2025 track in that direction? What will be different about this homebuying season? Should you consider buying or selling?

To get some answers, we talked with Chuck Meier, Senior Vice President – Director of Mortgage Sales at Sunrise Banks. Chuck has over 35 years of experience in financial services, including 30+ years in mortgage lending.

Q: Will 2025 be a better time to buy a house than in the past few years?

Chuck: Indicators are leaning toward a better housing market in 2025. Inventories continue to grow and the amount of time houses are on the market is rising. These are both good signs for homebuyers.

Q: What are your thoughts on home prices and affordability?

Chuck: This will depend on price points in specific markets. Home prices will remain elevated in the entry-level housing market, with demand being greater. This, along with continued higher rates, will keep affordability elevated.

Increased housing prices and rates have decreased the amount most borrowers can qualify for. For example, if a borrower has an income of $100,000 per year and rates are 4%, they may qualify for a $356,000 mortgage. If they have the same income and rates are 7%, the borrower then may only qualify for a $255,000 mortgage. If housing prices are higher, it’s harder to find a home in their price range.

Q: Do you anticipate it will be a seller’s or buyer’s market?

Chuck: In general, it will be a seller’s market, especially in the median-priced home range. It’s likely to move toward a buyer’s market for higher-priced homes.

Q: Do you have any mortgage rate predictions?

Chuck: It’s very hard to say. From what I am seeing, rates may come down some, but not enough to spur a big change. It appears rates will remain in the mid-to-low 6% range.

Q: What advice would you share with prospective homebuyers?

Chuck: If you can afford it, buying a home is still one of the best investments out there. It’s much better than paying rent, which isn’t investing in anything.

Q: Are there any other predictions or thoughts you’d like to share?

Chuck: Continue to expect the unexpected and be ready to adapt to change. Don’t let fear drive your decisions or hold you back. This year, like any year in history, will be a good time to buy a home – so go get your dream home.

At Sunrise Banks, we believe homeownership should be an option for everyone and that each homebuyer’s journey is different. You can reach out to our experienced mortgage loan officers at www.sunrisebanks.com/mortgage.

Sunrise Banks: Member FDIC and Equal Housing Lender.