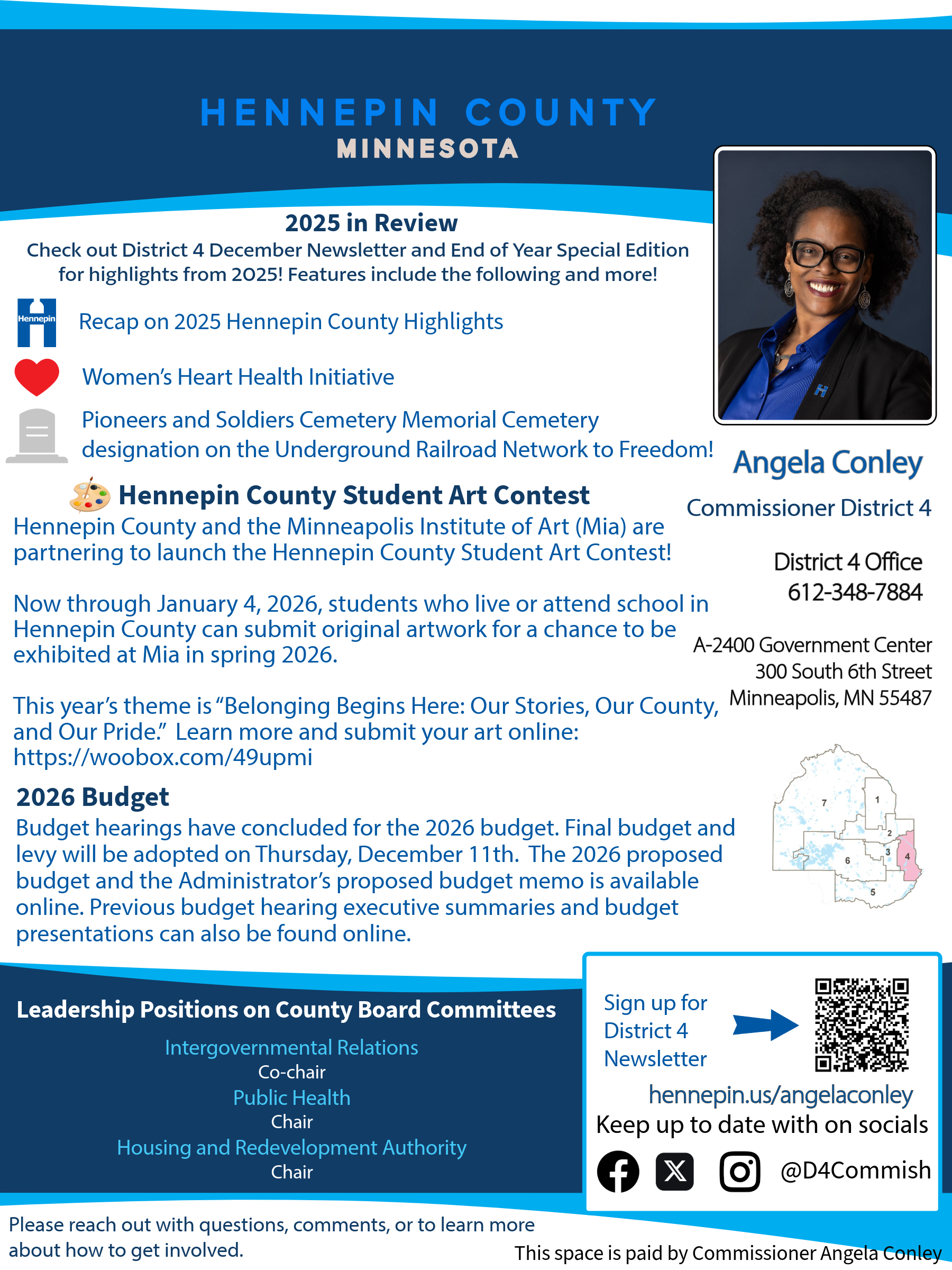

By AMANDA THEISEN, Communications Manager at Sunrise Banks

Helping communities thrive takes a lot of resources. Innovation and creativity can’t happen without people, ideas and cooperation. And progress can’t happen without time, talent and commitment.

Then there’s the money factor. Whether someone wants to start a business, a nonprofit wants to expand its programming, or a community wants to revitalize buildings in their neighborhood, it always takes some form of money to make that happen.

That’s where a program like the New Markets Tax Credit comes in. And if you’re a business owner, a nonprofit leader or a community activist working in a low-income neighborhood, low-cost financing options through the New Markets Tax Credit allocation recently awarded to Sunrise Banks may be a good fit for your project.

What is the New Markets Tax Credit program?

Launched in 2000, the New Markets Tax Credit (NMTC) program is a federal tax credit that is designed to incentivize investment in low-income communities. Each year the U.S. Treasury, as authorized by Congress, awards $5 billion to qualified lending institutions across the country, who in turn monetize the tax credits from those awards and provide low-cost financing in their respective communities. That financing can go to build new facilities, expand and refurbish existing buildings, help business owners open brick-and-mortar locations, and revitalize neighborhoods.

Sunrise Banks recently received a $50 million award from the U.S. Treasury for the latest round of NMTC allocation. The bank is now inviting small businesses, nonprofits, developers, and other community development entities in low-income communities to apply to receive funding for these projects.

“Supporting customers and projects in low to moderate-income communities is a core component of how we do business,” says Bryan Toft, Chief Revenue Officer at Sunrise Banks. “With this new round of NMTC allocation, we will be able to do more to be a force for good for the people we serve.”

“We have been able to financially support many innovative projects and businesses throughout the Twin Cities with these types of investments,” says Mary Stoick, Director of Tax Credit Lending at Sunrise Banks. “In turn, they have helped to create jobs, drive economic growth, revitalize communities and lift people out of poverty.”

Which Projects are Eligible?

Projects eligible for NMTC allocation through Sunrise Banks must be located in census tracts in the five-county metro area of the Twin Cities (Hennepin, Ramsey, Dakota, Anoka or Washington) that are also designated as economically distressed by the U.S. Census Bureau. They can range from large, high-profile nonprofits building a new HQ or programming space to small businesses and emerging developers buying their first buildings and launching their first projects.

Several projects in the Phillips neighborhood and surrounding communities have benefited from NMTC allocations. They include the recent expansion and renovation of the Minneapolis American Indian Center, the refurbishing of the Historic Coliseum Building on East Lake Street, the Seward Co-op’s Friendship Store expansion, and the Project for Pride in Living Career Training Center. Organizations such as the YMCA, Habitat for Humanity, Hope Academy and Junior Achievement have also received NMTC allocation for various building projects.

Stoick says Sunrise Banks has already started reviewing applications for this new round of New Markets Tax Credit allocation and welcomes additional inquiries and submissions. You can learn more about the program and fill out an application at https://sunrisebanks.com/products-and-services/business-banking/lending/new-markets-tax-credit/.

Member FDIC.

Amanda Theisen is the communications manager at Sunrise Banks.